Verifying your exchange account is an important step to ensure the security and legitimacy of your transactions. By verifying your account, you can enjoy higher trading limits, increased security features, and access to more advanced trading tools. Whether you’re new to cryptocurrency trading or a seasoned investor, this step-by-step guide will help you navigate the verification process and get your account up and running in no time.

Step 1: Create an Account

The first step is to create an account on the exchange platform you wish to use. Most exchanges require basic information such as your name, email address, and a strong password. Make sure to choose a platform that is reputable and has a history of secure transactions.

Step 2: Complete the KYC Process

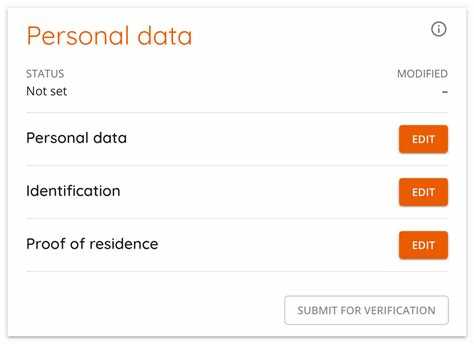

Once your account is created, you will need to complete the Know Your Customer (KYC) process. This usually involves providing additional personal information and uploading identification documents, such as a passport or driver’s license. KYC is designed to prevent fraud and money laundering, so be prepared to provide accurate and verifiable information.

Step 3: Verify your Identity

After completing the KYC process, you may be required to undergo additional identity verification steps. This can include taking a selfie or providing a proof of address, such as a utility bill or bank statement. These steps help confirm that the person creating the account is indeed the person they claim to be.

Step 4: Enable Two-Factor Authentication

As an additional security measure, it is highly recommended to enable two-factor authentication (2FA) on your exchange account. This adds an extra layer of protection by requiring a verification code, usually sent to your mobile device, in addition to your password when logging in or making transactions.

By following these steps, you can confidently verify your exchange account and enjoy the benefits of a secure and trusted platform. Remember to always keep your account information and login credentials confidential, and regularly update your password to ensure maximum security.

Step-by-Step Guide to Verify Your Exchange Account

Verifying your exchange account is an essential step to ensure the security and legitimacy of your transactions. Follow these step-by-step instructions to successfully verify your exchange account:

- Log in to your exchange account: Visit the official website of your exchange and enter your login credentials.

- Find the account verification settings: Once you have logged in, navigate to your account settings. Look for a tab or option related to “account verification” or “KYC (Know Your Customer) verification.”

- Provide your personal information: In the verification section, you will need to provide your personal information, such as your full name, date of birth, residential address, and contact details. Ensure that the information you provide is accurate and matches your legal documents.

- Upload identification documents: Typically, exchanges require you to upload scanned copies or photos of your identification documents, such as a passport, driver’s license, or national ID card. Make sure the documents are clear and visible.

- Verify your address: Some exchanges may require you to provide proof of address. This can be done by uploading a recent utility bill, bank statement, or any other document that clearly shows your residential address.

- Submit the verification request: After filling in the required information and uploading the necessary documents, review your details and click on the “submit” or “verify” button to initiate the verification process.

- Wait for approval: The verification process may take some time, ranging from a few hours to several days. Be patient and regularly check your email or account notifications for any updates on the verification status.

- Follow any additional instructions: In some cases, the exchange may ask for additional information or documentation. If requested, provide the requested information promptly to avoid any delays in the verification process.

- Receive confirmation: Once your account has been successfully verified, you will receive a confirmation email or notification. This will indicate that you can now access the full range of features and services provided by the exchange.

Remember that each exchange may have slightly different verification processes and requirements. It is important to carefully read and follow the instructions provided by your specific exchange to ensure a successful verification.

By completing the verification process, you are taking crucial steps to protect your account and comply with regulatory requirements. It will also grant you access to higher transaction limits and improved security features, enhancing your overall trading experience on the exchange.

Create an Account

To verify your exchange account, you first need to create an account. Follow the steps below:

- Visit the exchange website.

- Look for the “Sign up” or “Create account” button/link and click on it.

- Fill in the registration form with your personal information.

- Provide a valid email address and create a strong password for your account.

- Agree to the exchange’s terms and conditions by checking the appropriate box.

- Click on the “Create account” button to submit your registration.

After completing these steps, you will receive a confirmation email from the exchange. Click on the verification link in the email to verify your account and proceed with the verification process.

Provide Personal Information

Before you can verify your exchange account, you will need to provide personal information. This information is necessary to comply with anti-money laundering (AML) and know your customer (KYC) regulations. Here are the steps you need to follow:

- Full Name: Enter your full legal name as it appears on your identification documents.

- Date of Birth: Provide your date of birth to confirm your age and eligibility for trading.

- Residential Address: Enter your current residential address where you currently reside.

- Phone Number: Provide a valid phone number that can be used for verification and communication purposes.

- Email Address: Enter a valid email address where you will receive account-related notifications and updates.

- Identification Documents: Prepare scanned copies or clear photos of your identification documents, such as a passport or driver’s license. Make sure the documents are valid and not expired.

- Social Security Number (SSN) or National Identification Number (NIN): Some exchanges may require you to provide your SSN or NIN for identity verification purposes.

Make sure to double-check all the information you provide to ensure accuracy and avoid potential delays in the verification process. Keep in mind that different exchanges may have slightly different requirements, so be sure to review their specific instructions thoroughly. Once you have gathered all the necessary information, you can proceed with the verification process as outlined by the exchange. This typically involves submitting the required documents and waiting for them to be reviewed and approved by the exchange’s compliance team.

Upload Identification Documents

Verifying your exchange account typically requires uploading identification documents, such as a government-issued ID card or passport. This process helps ensure the security and legitimacy of your account.

Follow these steps to upload your identification documents:

- Log in to your exchange account and navigate to the verification or account settings section.

- Look for an option to upload identification documents. This may be labeled as “KYC” (Know Your Customer) or “Identity Verification.”

- Click on the upload button or select the option to upload files.

- Locate the identification documents on your device. Ensure that they are scanned or photographed clearly, with no visible blur or glare.

- Select the identification documents and click on the “Upload” or “Submit” button.

- Wait for the verification process to complete. This may take some time, depending on the exchange’s procedures.

It is essential to upload high-quality and valid identification documents to ensure a successful verification process. Here are some tips for uploading your documents:

- Valid Documents: Make sure your identification documents are valid and not expired. Expired documents may lead to verification failures.

- Clear Images: Ensure that the scanned or photographed images of your documents are clear and legible. Blurry or unclear images may cause delays or rejections.

- No Modifications: Do not modify or alter your identification documents in any way. This includes editing, cropping, or adding any sort of watermark or border.

- Supported Formats: Check the supported file formats for document uploads. Most exchanges accept PDF, JPEG, or PNG files.

- Size Limitations: Pay attention to any size limitations mentioned by the exchange. If your document exceeds the allowed size, you may need to compress or resize it.

Once your identification documents are uploaded, the exchange will review and compare them with the information provided during the registration process. If everything matches and the documents are satisfactory, your account will be verified, granting you access to various features and trading options on the exchange.

Remember to follow the exchange’s instructions and guidelines accurately to ensure a smooth verification process. If you encounter any difficulties or have questions, reach out to the exchange’s customer support for assistance.

Complete Additional Security Measures

In addition to verifying your exchange account, there are several additional security measures you can take to further secure your account and protect your assets. These measures include:

- Enable Two-Factor Authentication (2FA): Two-Factor Authentication adds an extra layer of security to your account by requiring both a password and a second verification method, such as a code sent to your phone or an authentication app.

- Set a Strong Password: Create a unique, complex password for your exchange account that combines uppercase and lowercase letters, numbers, and special characters. Avoid using common words or personal information that can be easily guessed.

- Keep Software and Devices Updated: Regularly update your computer operating system, web browser, and mobile devices to ensure you have the latest security patches and protections against known vulnerabilities.

- Beware of Phishing Attempts: Be cautious of suspicious emails, text messages, or phone calls that ask for your account information or credentials. Always double-check the URL of the exchange website before entering your login details.

- Monitor Your Account Activity: Regularly review your account activity and transaction history for any unusual or unauthorized activity. Report any suspicious activity to the exchange immediately.

By following these additional security measures, you can greatly enhance the security of your exchange account and reduce the risk of unauthorized access or potential loss of funds.

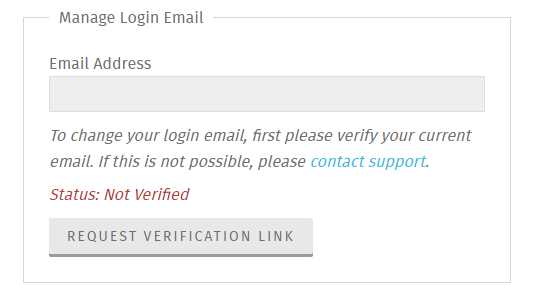

Confirm Your Email Address

To verify your exchange account, you will need to confirm your email address. This is an important step to ensure the security of your account.

- Check your inbox for an email from the exchange platform.

- Open the email and locate the verification link.

- Click on the verification link to confirm your email address.

If you cannot find the email in your inbox, make sure to check your spam or junk folder. Sometimes, the email might be filtered out by mistake.

After clicking the verification link, you will be redirected to a confirmation page on the exchange platform. This page will confirm that your email address has been successfully verified.

Once your email address is confirmed, you will be able to proceed with the next steps of verifying your exchange account.

Important: If you do not confirm your email address within a certain time period, your account may be suspended or closed.

Activate Two-Factor Authentication

Two-Factor Authentication (2FA) adds an extra layer of security to your exchange account by requiring you to provide a second form of authentication in addition to your password. This helps protect your account from unauthorized access even if your password is compromised. Follow the steps below to activate Two-Factor Authentication for your exchange account:

- Open your exchange account and navigate to the account settings or security settings section. This location may vary depending on the exchange platform you are using.

- Look for the option to enable Two-Factor Authentication or 2FA. It is usually labeled as “Enable 2FA” or “Activate Two-Factor Authentication”.

- Click on the enable 2FA option to start the setup process.

- Choose the type of two-factor authentication you would like to use. The most common options are SMS authentication, Google Authenticator, or email verification codes.

- If you choose SMS authentication, provide your mobile phone number and wait for a verification code to be sent to your phone. Enter the code in the provided field to verify your phone number.

- If you choose Google Authenticator, install the Google Authenticator app on your mobile device. Follow the app’s instructions to scan the QR code displayed on the exchange website. The app will generate a unique verification code that you need to enter in the provided field to complete the setup.

- If you choose email verification codes, provide your email address and click on the verification link sent to your email. This will confirm your email address and complete the setup process.

- Once you have completed the setup, the Two-Factor Authentication will be enabled for your exchange account. From now on, whenever you log in to your account, you will be asked to provide the second form of authentication, such as a verification code from your authentication app or a code sent to your phone or email.

By activating Two-Factor Authentication, you significantly enhance the security of your exchange account and protect your funds from unauthorized access. Make sure to keep your authentication app or phone/email access secure to prevent any potential security breaches.

Link Your Bank Account

Linking your bank account is an important step in verifying your exchange account. It allows you to deposit and withdraw funds easily. Here is a step-by-step guide on how to link your bank account:

- Login to your exchange account and go to the account settings section.

- Look for the option to add a bank account and click on it.

- Fill in the necessary information such as your bank name, account number, and routing number.

- Double-check the information you entered to ensure it is accurate.

- Submit your bank account information by clicking on the “Link Bank Account” button.

- Wait for the verification process. The exchange may need to verify your bank account by making a small deposit and asking you to confirm the exact amount.

- Once your bank account is verified, you will receive a confirmation email or notification from the exchange.

- Now you can start using your linked bank account to deposit or withdraw funds from your exchange account.

It is important to note that the verification process may vary depending on the exchange. Some exchanges may require additional documents or steps to verify your bank account. Make sure to follow the instructions provided by your chosen exchange closely to ensure a smooth verification process.

Start Trading on the Exchange!

Now that you have successfully verified your exchange account, you are ready to start trading cryptocurrencies. Follow these steps to begin trading:

- Select a Trading Pair: Choose the cryptocurrency pair you want to trade. For example, if you want to buy Bitcoin using US Dollars, select the BTC/USD trading pair.

- Place an Order: Decide whether you want to place a market order or a limit order. A market order will be executed at the current market price, while a limit order allows you to set a specific price at which you want your order to be executed.

- Review the Order: Double-check the details of your order, including the trading pair, the amount you want to buy/sell, and the price at which you want to execute the trade.

- Confirm the Order: Once you are satisfied with the order details, click on the “Confirm” button to place the trade.

- Monitor Your Trade: Keep an eye on the trade to see if it gets executed. If the trade is successful, you will see the cryptocurrency appear in your account.

- Manage Your Portfolio: As you continue trading, you can monitor your portfolio and make adjustments as needed. You might want to set up stop-loss orders to limit your potential losses or set profit targets to take advantage of price movements.

Remember, trading cryptocurrencies can be risky, so it’s important to do thorough research and only invest what you can afford to lose. Stay updated on market trends and use technical analysis tools to make informed decisions. Happy trading!

FAQ:

What is exchange account verification?

Exchange account verification is the process of confirming your identity and providing additional information to the exchange platform in order to comply with regulatory requirements and ensure the security of your account.

Why do I need to verify my exchange account?

Verification is necessary in order to comply with anti-money laundering (AML) and know your customer (KYC) regulations. It helps prevent fraud, money laundering, and other illegal activities on the exchange platform.

What documents do I need to provide for account verification?

The specific documents required may vary depending on the exchange platform, but typically you will need to provide a government-issued ID (such as a passport or driver’s license), proof of address (such as a utility bill or bank statement), and sometimes a selfie or photo of yourself holding the ID.

How long does the verification process usually take?

The verification process can vary in length, but it typically takes a few days to a week. Some exchanges may have a faster verification process, while others may take longer depending on the volume of verification requests they receive.